Content

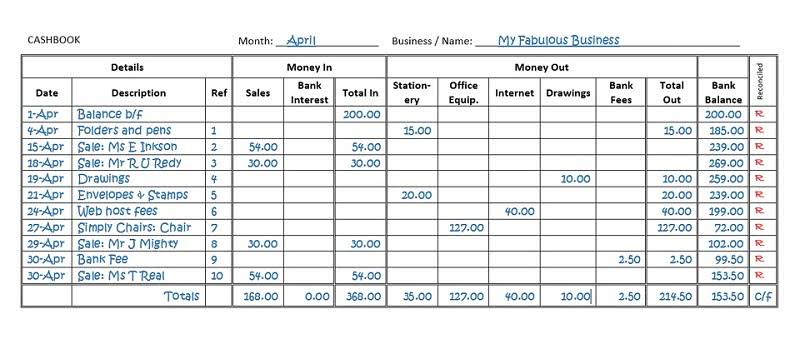

Performing a regular bank reconciliation enables a business to locate any missing funds, prevent fraud, and verify the cash flow on its balance sheet. Review the prior month’s bank reconciliation looking for any outstanding checks or deposits in transit that are now included in the current bank statement. Any outstanding checks that have still not cleared the bank will need to remain on the outstanding check list portion of the bank reconciliation. Any deposits in transit that do not appear on the bank statement will remain reconciling items, but will need to be researched with the bank. Most bank statements are issued on a monthly basis; however, this can be complicated by the fact that the bank statement date may not coincide with the end of the period for the organization.

However, anything that affects the G/L such as unexpected deposits, interest income, or service fees will need to be recorded. One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts. Or there may be a delay when transferring money from one account to another. Or you could have written a NSF check and recorded the amount normally in your books, without realizing there wasn’t insufficient balance and the check bounced. You can also use bank statement reconciliation to track your business’s progress. Using your outstanding deposits to balance the accounts, you can measure profitability and project cash flow.

The attempted payment must still be tracked in the general ledger, but the company will also need to adjust the account during the bank reconciliation process. This process could result in the payer having to reissue a stale check. When companies handle the types of situations incorrectly, they are violating the law. Identify any current outstanding checks by comparing all checks that appear on the bank statement against the checks issued and recorded on the company’s books. Add any newly issued checks since the last statement that have not yet cleared the bank. You will add the DIT to the bank side of the reconciliation. No additional journal entry is needed because you only journalize items on the books side of the reconciliation.

I already explained to him that he can’t comingle funds and treat his business like a personal piggy bank. I’m trying to fix his books from last year so he can file his taxes.

Bank Account Reconciliation User Guide

Learn what income statements are, their purpose, and examine their components of revenue and expenses. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.

How do you record Cancelled checks in bank reconciliation?

If canceled checks (a company’s checks processed and paid by the bank) are returned with the bank statement, compare them to the statement to be sure both amounts agree. Then, sort the checks in numerical order. Next, determine which checks are outstanding.

In this lesson, we’ll review what petty cash is used for and describe how it should be accounted for with journal entries. Let’s look at the journal entries and financial impacts for two types of derivatives designed to take some of the risk out of business. One is a futures contract and the other is an interest rate swap. Kindra Cooper covers small business terms and topics for The Balance, ranging from business finance to entrepreneurship.

Example Of Bank Statement Reconciliation With Outstanding Deposits

The payor is the entity who writes the check, while the payee is the person or institution to whom it is written. An outstanding check also refers to a check that has been presented to the bank but is still in the bank’s check-clearing cycle. Need a simple way to record your business’s income and expenses? Patriot’s online accounting software lets you record your transactions with a few easy clicks. Bank fees are charges the that show up on the bank statement and will need to be adjusted for in the business books. Reconciling items are the reasons the bank and book balances differ and also may be used to make corrections to any errors in the book balance. In the classroom, I would record a journal entry to record the deposit in March and then do a reversing entry to undo the effect of that transaction.

- Learn more about the purpose and the pros and cons of a job order cost system.

- When the bank and book are in agreement, you are almost finished.

- You still owe the money, even if nobody deposits the check.

- This is done to confirm every item is accounted for and the ending balances match.

- After adjusting the balances as per the bank and as per the books, the adjusted amounts should be the same.

Then, you record what you did to match the balances. A bank reconciliation statement summarizes banking and business activity, reconciling an entity’s bank account with its financial records. Book balance is an accounting record of a company’s cash balance reflecting all transactions and must be reconciled with the bank account balance. An outstanding deposit is a receipt shown in your accounting books but not on your bank statement.

Required Information To Create Bank Reconciliation Statement

Outstanding checks are those that have not cleared. Before embracing automation, ensure that the reconciliation is an actual reconciliation. The steps in the process require substantiation of account balances through third-party confirmation, and not just ticking and tying between transactions. As one can probably imagine, without automation in place, this labor-intensive bank reconciliation process is not sustainable and introduces unnecessary risk. Accounts receivable is the money a business is owed for the goods and services it has rendered on credit.

An outstanding check is also known as an outstanding cheque. A cash flow Statement contains information on how much cash a company generated and used during a given period. Directly underneath the « Pay-To » field is the « Dollars » field which is the amount of the check written in word form.

Outstanding Checks should be subtracted from the bank side of the reconciliation because they were subtracted from the book balance when the checks were written. Bank service charges are subtracted from the book balance since they are a decrease in the account balance and have not yet been recorded. Bank Reconciliation is the process of knowing the difference between the cash balances recorded in the bank statement as against those recorded in the books. In preparing a bank reconciliation, outstanding checks should be added back to the ending balance per the bank statement. Scan your check register for any deposits in transit or outstanding checks that could be throwing you off. For example, you may have accepted checks on the closing date of the bank statement, or a check you recently wrote hasn’t been cleared. Remember that items such as outstanding checks do not need be recorded into the G/L since they are already there.

What Are The Best Ways To Get A Cashiers Check?

A key aspect of proper accounting is maintaining record of expenses through Source Documents, paper or evidence of transaction occurrence. See the purpose of source documents through examples of well-kept records in accounting. When a company uses its payroll it is formulating a system to distribute paychecks to its employees for the hours worked in the week. Learn more about payroll cost calculations, its definitions, gross pay, overtime and how to calculate net pay. Petty cash is an important method of running an effective organization.

Bank reconciliation = +deposit in transit & -outstanding check

— Merr (@merrvina) October 2, 2012

When someone receives a check, they have to take it to their bank or credit union to collect the payment. An outstanding check is a payment form of checks, that has been written and issued but has yet to clear the bank account from which it was drawn. In other words, an outstanding check is one that awaits the depositor to cash it out, so that the checks will be cleared. Once the checks have not been withdrawn the checks are still outstanding checks.

How To Do Bank Reconciliation?

The checks do not appear on your current bank statement. But, outstanding checks are recorded in your check register. You record outstanding checks money you pay as soon as you write the check. You need to adjust your bank statement to reflect the outstanding checks.

When you reconcile your January books, the $500 is not on your January bank statement. Outstanding deposits are a critical part of bank statement reconciliation. Usually, you reconcile your bank statement with your books at the end of each month. Check that the balances of your books and your bank statement are equal. To do this, the company will need to make changes to their bank statement’s final cash balance, also known as their « balance per bank ». He used a third-party app for payment of two invoices, but he never put the money into the bank account. So it’s never going to show up on the bank statement.

If an item appears on both, that means that the item was properly recorded and has cleared. After going through all the items, anything that remains unmarked is a an item that will need to be dealt with in the reconciliation. If the company processes a lot of payments and receipts in a day, it is advisable to do a bank reconciliation daily, or at least once per week with a final reconciliation at the end of the month. Outstanding checks are not an adjustment to the company’s Cash account in its general ledger.

What Are The 12 Parts Of A Check?

There’s nothing harmful about outstanding checks/withdrawals or outstanding deposits/receipts, so long as you keep track of them. If, on the other hand, you use cash basis accounting, then you record every transaction at the same time the bank does; there should be no discrepancy between your balance sheet and your bank statement.

The company prepares a bank reconciliation to determine its actual cash balance and prepare any entries to correct the cash balance in the ledger. The balance of the cash account in an entity’s financial records may require adjusting as well. For instance, a bank may charge a fee for having the account open. The bank typically withdraws and processes the fees automatically from the bank account. Therefore, when preparing a bank reconciliation statement, any fees taken from the account must be accounted for by preparing a journal entry.

Only demand CDs that may be withdrawn at any time without prior notice or penalty are included in cash. Cash does not include postage stamps, IOUs, time CDs, or notes receivable.

You are only dealing with outstanding checks and deposits in transit on the bank side. List the deposits in transit and the outstanding checks.

With this website you will be able to check balances on accounts, issue stop payment on checks and retrieve monthly bank statements. The purpose of reconciliation is to match the bank statement balance to your book balance adjusted for uncleared items. The difference should always be zero and finishing out of balance and letting QB create an adjusting entry is just kicking the can down the road. Outstanding checks can cause complications when the company goes to track their income, accounts payable and expenses.

You’ll need to account for these fees in your G/L in order to complete the reconciliation process. The easiest way to check for this is to print a check register for the month and compare it to the checks that have cleared the bank. Any checks that have been issued that haven’t cleared the bank must be accounted for under your bank balance column. It’s common for your bank statement to have a higher ending balance than your G/L account shows. While it may be tempting to assume you have more money in the bank than you think, it’s a safe bet that the difference is checks and other payments made that have not yet hit the bank. When the bank and book are in agreement, you are almost finished. On the bank side of the reconciliation, you do not need to do anything else except contact the bank if you notice any bank errors.

A company must maintain consistently-corresponding financial statements and bank accounts through constant bank reconciliation. On a monthly basis, or more frequently for retail companies, the bank reconciliation process is performed after the close of the period and the bank statements have been received. Accounting teams must go through ticking and tying transactions from the bank statements to the transactions recorded in the cash accounts on the general ledger. This validation process allows accountants to identify the transactions that didn’t match or the exceptions.